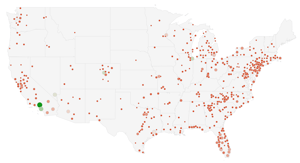

Hotspots for Real Estate Investment: Where Absentee Owners Dominate the Market

The Top 50 US Counties with the Highest Percentage of Absentee-Owned Properties

Understanding the distribution of absentee-owned properties can provide valuable insights into market trends and investment opportunities. Let's delve into the details of each of the top 50 counties with the highest percentage of absentee ownership and explore why these areas might attract such property ownership.

Factors Driving High Absentee Ownership

Several factors contribute to high absentee ownership in these counties:

-

Vacation Destinations: Many of these counties are popular vacation spots with beautiful beaches, warm climates, and vibrant communities, making them attractive for second homes.

-

Investment Opportunities: Investors are drawn to areas with strong rental markets, growing economies, and high demand for rental properties.

-

Retirement Havens: Counties with favorable climates and lower costs of living attract retirees who purchase second homes.

-

Urban Centers: Major cities and metropolitan areas offer robust job markets and amenities, driving demand for rental properties and investment opportunities.

-

Affordability: Some counties offer more affordable housing compared to neighboring areas, attracting investors looking for better returns on investment.

1. Lee County, FL - 36.92%

Lee County boasts a high absentee ownership percentage due to its appeal as a vacation destination with beautiful beaches, golf courses, and a warm climate. The region attracts retirees and vacation home buyers, contributing to the high number of absentee-owned properties.

2. Ocean County, NJ - 23.91%

Ocean County's coastal location makes it a popular spot for vacation homes. Proximity to major cities like New York and Philadelphia allows for easy getaways, leading to a high number of second homes and investment properties.

3. Clark County, NV - 23.73%

Home to Las Vegas, Clark County sees a significant number of absentee owners due to its strong tourism industry. Investors purchase properties for short-term rentals, benefiting from the steady influx of visitors.

4. Palm Beach County, FL - 22.36%

Known for its luxurious lifestyle and affluent communities, Palm Beach County attracts wealthy individuals looking for vacation homes. The upscale amenities and beachfront properties are key factors driving absentee ownership.

5. Fresno County, CA - 22.01%

Fresno County offers a mix of urban and rural environments, attracting investors looking for rental properties. The agricultural industry also brings in absentee owners who invest in farmland.

6. Sacramento County, CA - 21.11%

Sacramento's growing economy and proximity to the Bay Area make it attractive for investors. Many purchase properties as rental investments, contributing to the high absentee ownership rate.

7. Pima County, AZ - 20.80%

With Tucson as its county seat, Pima County appeals to retirees and vacationers seeking a warm climate. The lower cost of living compared to other parts of Arizona makes it a popular choice for second homes.

8. Broward County, FL - 20.72%

Broward County's location along the southeastern coast of Florida, combined with its vibrant cultural scene and beaches, attracts absentee owners looking for vacation homes and rental properties.

9. Collin County, TX - 19.17%

Part of the Dallas-Fort Worth metropolitan area, Collin County sees high absentee ownership due to its robust economy and job market. Investors purchase properties to rent out to the growing population.

10. Denton County, TX - 19.12%

Denton County's growth and proximity to Dallas-Fort Worth make it a prime location for investment properties. Many absentee owners rent out properties to students and young professionals.

11. Pinellas County, FL - 19.11%

With cities like St. Petersburg and Clearwater, Pinellas County is a hotspot for vacation homes. The beautiful Gulf Coast beaches and year-round sunshine attract many absentee owners.

12. Fort Bend County, TX - 18.64%

Located near Houston, Fort Bend County has a diverse economy and strong real estate market. Many investors purchase properties for rental income, contributing to the high absentee ownership rate.

13. Riverside County, CA - 18.53%

Riverside County's proximity to Los Angeles and its affordability compared to neighboring counties make it attractive for investors and second home buyers.

14. Hillsborough County, FL - 18.48%

Hillsborough County, home to Tampa, attracts absentee owners due to its vibrant city life, cultural attractions, and waterfront properties.

15. Franklin County, OH - 18.11%

Columbus, the state capital, is located in Franklin County. The city's growing economy and job market attract investors who purchase rental properties.

16. Orange County, FL - 17.81%

Home to Orlando and major attractions like Disney World, Orange County has a strong short-term rental market, drawing many absentee owners.

17. Bexar County, TX - 17.57%

San Antonio's growing economy and tourism industry make Bexar County attractive for investment properties, resulting in high absentee ownership.

18. Pierce County, WA - 17.37%

Pierce County, with Tacoma as its largest city, attracts absentee owners due to its scenic beauty, proximity to Seattle, and growing job market.

19. Duval County, FL - 17.16%

Duval County, encompassing Jacksonville, offers a mix of urban and beach lifestyles. Its affordability and investment potential attract many absentee owners.

20. Alameda County, CA - 16.83%

Part of the San Francisco Bay Area, Alameda County is a prime location for rental properties due to its high housing demand and strong job market.

21. Tarrant County, TX - 16.49%

Tarrant County, part of the Dallas-Fort Worth metropolitan area, attracts investors looking for rental properties in a growing market.

22. Travis County, TX - 16.45%

Austin, located in Travis County, is a tech hub with a booming real estate market. The city's growth and popularity drive high absentee ownership.

23. El Paso County, TX - 16.25%

El Paso's affordable housing market and strategic location near the US-Mexico border attract investors looking for rental properties.

24. San Mateo County, CA - 16.21%

San Mateo County, part of Silicon Valley, sees high absentee ownership due to its strong job market and high property values, making it attractive for investors.

25. Williamson County, TX - 16.18%

Part of the Austin metropolitan area, Williamson County's growth and appeal to young professionals drive investment in rental properties.

26. Contra Costa County, CA - 16.08%

Contra Costa County, located in the Bay Area, attracts absentee owners due to its proximity to San Francisco and investment potential.

27. Pima County, AZ - 15.99%

Pima County, with Tucson as its county seat, attracts retirees and vacationers seeking a warm climate, resulting in high absentee ownership.

28. Maricopa County, AZ - 15.83%

Phoenix, located in Maricopa County, has a booming real estate market. The area's affordability and growth attract many absentee owners.

29. San Mateo County, CA - 15.75%

San Mateo County's inclusion in Silicon Valley drives high absentee ownership due to the strong rental market and investment opportunities.

30. Williamson County, TX - 15.72%

Williamson County's second appearance on the list highlights its growing appeal for investors and absentee owners seeking rental properties.

31. Volusia County, FL - 15.70%

Volusia County, with cities like Daytona Beach, attracts absentee owners looking for vacation homes and rental properties along the coast.

32. Fairfax County, VA - 15.61%

Fairfax County, part of the Washington, D.C. metropolitan area, attracts investors due to its strong economy and high demand for rental properties.

33. Kern County, CA - 15.57%

Kern County's affordability and growth potential attract absentee owners looking for investment properties in California's Central Valley.

34. Mecklenburg County, NC - 15.54%

Charlotte, located in Mecklenburg County, is a financial hub with a growing real estate market, attracting many absentee owners.

35. San Bernardino County, CA - 15.45%

San Bernardino County's affordability and proximity to Los Angeles make it a popular choice for investment properties and second homes.

36. Brevard County, FL - 15.41%

Brevard County, home to the Space Coast, attracts absentee owners looking for vacation homes and rental properties near the beach.

37. Polk County, FL - 15.39%

Polk County's central location in Florida and affordable housing market attract absentee owners seeking investment properties.

38. Ventura County, CA - 15.24%

Ventura County's coastal location and high quality of life attract absentee owners looking for second homes and investment properties.

39. San Diego County, CA - 15.21%

San Diego County's desirable climate, beaches, and strong rental market drive high absentee ownership.

40. Sarasota County, FL - 15.20%

Sarasota County's appeal as a retirement destination and vacation spot results in a high number of absentee-owned properties.

41. Hudson County, NJ - 15.03%

Hudson County's proximity to New York City makes it attractive for investment properties, leading to high absentee ownership.

42. Forsyth County, NC - 14.94%

Forsyth County, with Winston-Salem as its largest city, attracts investors due to its affordable housing market and growing economy.

43. Santa Clara County, CA - 14.93%

Santa Clara County, part of Silicon Valley, sees high absentee ownership due to its strong job market and high property values.

44. King County, WA - 14.84%

King County, home to Seattle, attracts absentee owners due to its booming tech industry and strong rental market.

45. Montgomery County, TX - 14.83%

Montgomery County's growth and proximity to Houston make it a prime location for investment properties and absentee ownership.

46. Volusia County, FL - 14.83%

Volusia County appears again, highlighting its appeal for vacation homes and rental properties along the coast.

47. Seminole County, FL - 14.82%

Seminole County's proximity to Orlando and high quality of life attract absentee owners looking for investment properties.

48. Los Angeles County, CA - 14.77%

Los Angeles County's large population and strong rental market drive high absentee ownership.

49. Orange County, CA - 14.66%

Orange County's desirable location, beaches, and affluent communities attract absentee owners seeking second homes and investment properties.

50. Baltimore County, MD - 14.48%

Baltimore County's proximity to Washington, D.C., and affordable housing market make it attractive for investment properties.

Why High Absentee Ownership?

Several factors contribute to high absentee ownership in these counties:

-

Vacation Destinations: Many of these counties are popular vacation spots with beautiful beaches, warm climates, and vibrant communities, making them attractive for second homes.

-

Investment Opportunities: Investors are drawn to areas with strong rental markets, growing economies, and high demand for rental properties.

-

Retirement Havens: Counties with favorable climates and lower costs of living attract retirees who purchase second homes.

-

Urban Centers: Major cities and metropolitan areas offer robust job markets and amenities, driving demand for rental properties and investment opportunities.

-

Affordability: Some counties offer more affordable housing compared to neighboring areas, attracting investors looking for better returns on investment.

By focusing on these high absentee ownership counties, real estate agents and investors can identify lucrative opportunities and develop strategies to connect with absentee owners. For more insights and access to comprehensive absentee owner leads, visit The Share Group. Let's unlock the potential of these high-opportunity areas together.