MORTGAGE LEADS

The Share Group offers high-quality mortgage leads designed to support real estate agents and investors in expanding their businesses.

WHAT ARE SHARE GROUP MORTGAGE LEADS?

Mortgage leads are your golden ticket to connecting directly with ReFI prospects. Think about it—homeowners trapped in a 7% Mortgage need to hear from you! They’re looking for LO's who can guide them through the process from start to finish with a new lower monthly payment. With the right mortgage leads, you build relationships that can lead to faster sales cycles and a pipeline full of eager prospects.

Why Choose The Share Group for Mortgage Leads?

In a competitive real estate market, having exclusive access to high-quality leads can make all the difference.

The Share Group specializes in providing mortgage leads tailored to your business needs, helping you secure clients who are actively seeking financial solutions for their home-buying journey or refinancing needs.

Our Mortgage Lead Services Include:

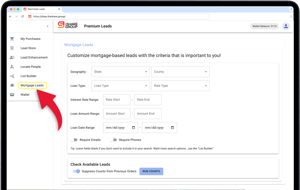

- Incredible Selectivity:

- Geography

- Mortgage Type, Date, Amount, Interest Rate, Lender Name,

- Deed Type: Trust, Nominal, Administrator, Agreement, etc.

- Owner and Non Owner Occupied

- Property Information: Use, Pool, Roof, Garage, etc.

- Real-Time Lead Generation: Get mortgage leads fast, ensuring they are fresh, active, and ready to engage.

- Phones Guaranteed to Work:

- Land and Wireless phones

- DNC noted for each

- Mailing lists too -no phone

- Volume Pricing: The more you buy, the less you pay per lead

- Direct Mail Services

- Free Cold Calling by US Based professionals

How To Get Started

Give us your contact info to learn more. You can always call us at 402-235-4556 with any questions.Mortgage Leads FAQs

With The Share Group, you get a partner that works to fuel your growth, helping you reach the right buyers at the right time.

These selection criteria provide key personal, contact, and property information for building a targeted marketing list.

They include individual details like name, address, and age, alongside property attributes such as value, sale history, and mortgage details.

Together, these elements create a comprehensive profile to effectively identify and connect with potential customers.

- First Name: The given name of an individual.

- Middle Name: The secondary or additional given name of an individual.

- Last Name: The family name or surname of an individual.

- Address: The street and number where an individual resides or receives mail.

- City: The municipality where an individual resides.

- State: The U.S. state where an individual resides.

- Zip: The postal code associated with an individual's address.

- Email: The electronic mail address used for communication.

- Phone: The primary contact phone number.

- Phone Type: The classification of the phone number (e.g., mobile, landline).

- Phone 2: A secondary contact phone number.

- Phone Type 2: The classification of the secondary phone number (e.g., mobile, work).

- Latitude: The geographic latitude of the property location.

- Longitude: The geographic longitude of the property location.

- Date of Birth: The date an individual was born.

- Exact Age: The precise age of an individual.

- Ethnic Code: A code representing the ethnicity of an individual.

- Market Total Value: The total estimated value of a property on the market.

- Sale Date: The date when the property was last sold.

- Sale Price: The price at which the property was sold.

- Loan to Value: The ratio of the loan amount to the property's appraised value.

- Year Built: The year when the property was constructed.

- Living Square Feet: The total livable floor space of a property, measured in square feet.

- Bedrooms: The number of bedrooms in the property.

- Total Baths: The total number of bathrooms in the property.

- Owner Occupied: Indicates if the property is occupied by the owner.

- Purchase Mortgage Date: The date the initial mortgage was taken out on the property.

- Purchase Mortgage Term: The duration or term of the purchase mortgage.

- Purchase Lender Name: The name of the lender who provided the purchase mortgage.

- Purchase 1st Mortgage Amount: The amount of the first mortgage taken at the time of purchase.

- Purchase 1st Mortgage Loan Type Code: A code indicating the type of first mortgage loan.

- Purchase 1st Mortgage Deed Type: The type of deed used for the first mortgage.

- Purchase 1st Mortgage Interest Rate Type: The type of interest rate (fixed or variable) for the first mortgage.

- Purchase 1st Mortgage Interest Rate: The interest rate for the first mortgage.

- Purchase 2nd Mortgage Amount: The amount of the second mortgage taken at the time of purchase.

- Purchase 2nd Mortgage Loan Type Code: A code indicating the type of second mortgage loan.

- Purchase 2nd Mortgage Deed Type: The type of deed used for the second mortgage.

- Purchase 2nd Mortgage Interest Rate Type: The type of interest rate (fixed or variable) for the second mortgage.

- Purchase 2nd Mortgage Interest Rate: The interest rate for the second mortgage.

- Most Recent Mortgage Loan Type Code: A code indicating the type of the most recent mortgage loan.

- Most Recent Mortgage Deed Type: The type of deed used for the most recent mortgage.

- Most Recent Mortgage Interest Rate Type: The type of interest rate (fixed or variable) for the most recent mortgage.

- Most Recent Lender Name: The name of the lender providing the most recent mortgage.

- Title Company Name: The name of the company that handled the title transfer during the purchase.

We offer real-time, high-quality leads with advanced segmentation, allowing for highly targeted outreach. Our leads are refreshed regularly to ensure you connect with active, engaged clients.All phones work or they are replaced at no charge.

Absolutely. You can customize your leads by purchase intent, geographic location, financial criteria, and more to align with your target market.

After setting up your account and defining your target criteria, you’ll receive leads within 1 business day, allowing you to start your outreach immediately.

ORDER ONLINE

Visit our Lead Shop to get counts & pricing for all lead types in Your Market!

SCHEDULE A MEETING WITH A LEAD EXPERT

Find Motivated Mortgage Leads to Power Your Business

The Share Group is the trusted choice for real estate agents and investors looking for high-quality mortgage leads.

Our targeted data and advanced analytics help you connect with potential clients actively exploring mortgage options, including new purchases, refinancing, home equity loans, and more.

With our expertise, you can focus on building relationships and growing your business with clients who are ready to act.

HERE'S HOW IT WORKS

Getting started is quick and easy — just follow these simple steps to access quality seller leads and grow your real estate business.

Select the leads that fit your needs, complete your purchase, and download them instantly—all within five minutes.

REALTOR TESTIMONIALS

See what our customers have to say...

At the Share Group we have the highest standards. As a result we have the happiest customers in the business.

LEAN ON OUR EXPERTS

You don’t have to do it alone. Our team of marketing experts is waiting to help you.